STRATEGIC BETA: FACTORS

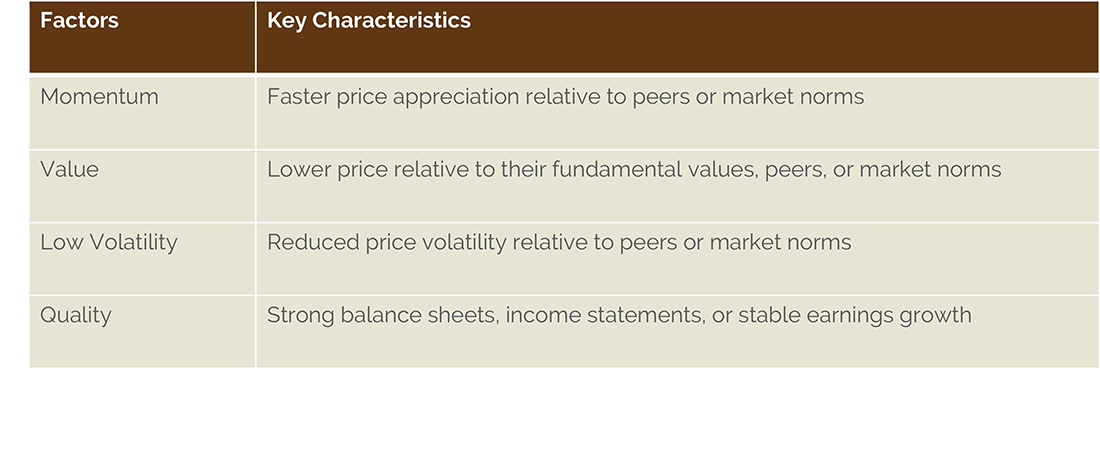

Factor Exchange Traded Funds (ETF’s) are publicly-traded groups of stocks that display a specific characteristic (or factor) such as reduced price volatility relative to peers or market norms. Our Dynamic Risk Management Factors (DRMF) strategy utilizes the following factor ETF’s.

Tilting Your Portfolio

We build and shape portfolios by overweighting or underweighting investments in specific ETF’s that display the above factors, with decisions based on two overarching criteria:

- How the market is behaving (technical analysis)

- How the market should be behaving (macroeconomic analysis)

How Markets Should Behave

As the business cycle shifts, markets rotate and provide us opportunities to adjust the portfolio. For example, momentum performs better in an accelerating market, while value tend to perform better coming out of a recession.

How Markets Are Behaving

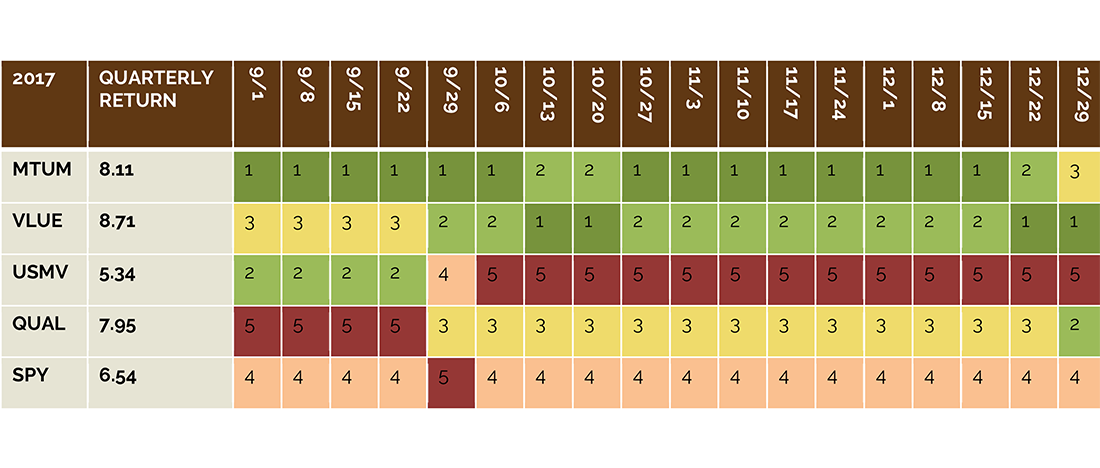

Technical analysis identifies positive price trends (moving from red to green) and the velocity of that change. This allows us to evaluate when to tilt the portfolio towards select factors.

Who Should Consider a Factors Strategy

This strategy is available for accounts with risk profiles ranging from conservative to aggressive growth. Alternatively, it can also be used to complement an existing buy and hold, strategic portfolio from other investment managers.

Minimum account size is $250,000 for institutions and $5,000 for individuals. There are no assurances the investment objectives will be achieved. Any chart reference to returns are for illustrative purposes only and does not reflect actual results.

We are a GIPS compliant investment advisory.