STRATEGIC BETA: SECTORS

The Standard & Poor’s 500 is composed of eleven different sectors, or types of companies. Sector examples include financials, materials, technology, energy and healthcare. Opportunities to capitalize on economic conditions, trading trends, and price patterns may arise as sectors respond to various stimuli and returns vary.

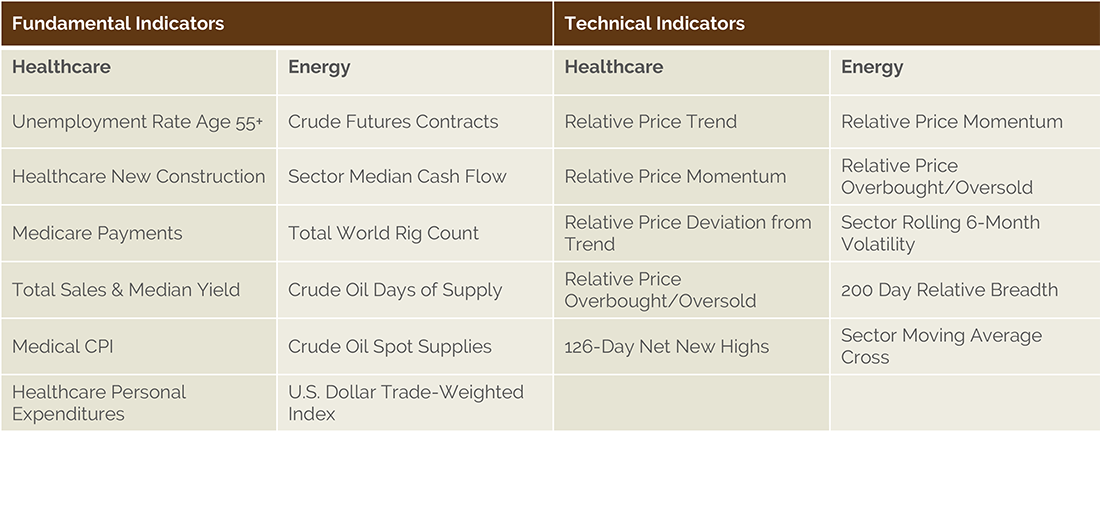

Our DRM Sectors strategy employs an optimized series of fundamental and technical indicators to identify and overweight favorably-positioned sectors and underweight those considered less favorable.

- Fundamental indicators reflect current economic conditions impacting each sector

- Technical indicators identify trading trends and price patterns

The table below illustrates indicators we might consider for two very different sectors: Health Care and Energy.

Who Should Consider a Sectors Strategy

This strategy is available for accounts with risk profiles ranging from conservative to aggressive growth. Alternatively, it can also be used to complement an existing buy and hold, strategic portfolio from other investment managers.

Minimum account size is $250,000 for institutions and $5,000 for individuals. There are no assurances the investment objectives will be achieved. Any chart reference to returns are for illustrative purposes only and does not reflect actual results.

We are a GIPS compliant investment advisory.